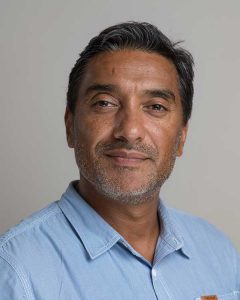

Minerva angel investors come from a broad range of business backgrounds. They offer their extensive knowledge and expertise helping tech start-ups and SMEs. Here, Nrinder Singh talks about his philosophy and experiences investing through the Minerva network.

Minerva angel investors come from a broad range of business backgrounds. They offer their extensive knowledge and expertise helping tech start-ups and SMEs. Here, Nrinder Singh talks about his philosophy and experiences investing through the Minerva network.

What’s your background and what led you to becoming an angel investor?

My background is in technology financing from a commercial and risk perspective, with companies including GE, HP and Xerox. Over the years I’ve helped smaller tech businesses grow, too.

I left the corporate world 10 years ago to focus on investments, mainly in assets and property. About six years ago I began investing with my own capital, which meant I could choose the businesses that I wanted to invest in. That appealed to my desire to help smaller, more innovative companies get their tech ideas off the ground. It was at that point I became an angel investor.

What attracted you to Minerva?

I’ve been investing through Minerva for about four years. I was first introduced to the network while working with start-ups through Aston University. Minerva is an established Midlands-focused angel network that is unique in the way their prime objective is to connect smart innovation with smart capital. That idea really appealed to me.

I wanted to offer my experience and expertise to small businesses with great ideas, to help and support them in financial, risk management and other complex areas such as commercial contracts. Minerva provides that combination of investing financially and investing myself in new companies in sectors and areas that I’m passionate about.

Minerva has close ties with academia, such as the University of Warwick Business School, so it sees many opportunities for tech innovation and new business start-ups. It attracts a lot of companies precisely because it’s not a venture capital (VC); that makes Minerva much more approachable for small companies looking to fundraise at an early stage.

What value does Minerva offer potential investors?

Minerva offers investors a way to find exactly the kind of businesses that they want to invest in. In that respect Minerva is more like a matchmaker than a typical VC group. It’s not looking to make a profit. Minerva’s purpose is to connect businesses with the right investment opportunity and the right investor. That means an investor who knows the sector, has an understanding of what the company does and wants to see their investment not just pay off financially, but also do some good in the world.

Investing through Minerva gives me the freedom to be as hands on or hands off as I want to be. Some investors like to be very involved with the companies they invest in. Some prefer a backseat. I’m happy with either – it’s whatever’s right for the businesses. Some companies need and want a lot of help and guidance. Others don’t. It’s all about what value I can add, getting over early hurdles and obstacles and taking advantage of opportunities.

It’s also about pointing the business in the right direction and using my expertise and sector knowledge to get the word out and help gain momentum with strategic introductions, getting the product or idea the right exposure.

What does Minerva offer you as an angel investor?

I could invest in companies whose sole purpose is to sell more products, to sell more units, trainers, gadgets or whatever. And that’s fine. But as an angel investor with Minerva, I’m able to invest in companies that are innovative and disruptive, giving them an opportunity to take new technology to market.

For example, I became the lead investor with a particular company, through a university, because I believed in their technology which has the potential to help more than a million people avoid premature blindness. Investing in MedTech that will make a significant difference in people’s quality of life gives me a positive social impact return on my investment.

With Minerva, investors can share their expertise, pooling their knowledge and experience to help each other find and better understand investment opportunities. It’s helped me grow, both as an investor and as an individual.

Minerva’s large and diverse investor base means there are experts across the network in a wide range of sectors and areas. Minerva is very supportive too, offering an educational series looking at, for example, due diligence, shareholder agreements, contracts and tax, something that I have found useful regarding EIS tax and how efficient angel investing can be.

What advice would you give to people who might be interested in becoming an angel investor?

My advice would be to come and see what Minerva can offer. Attend an event and talk with other angel investors. There will be a lot of experience in the room and there is absolutely no pressure to invest. It’s about finding a company that fits your investment criteria, regardless of how long (or how quickly) that takes.

Being an angel investor means going over and above just investing capital. It’s great when there’s synergy between the investor and the company in some way so that you get something out of the investment that’s not solely about the financial return. What I really like about Minerva is that it looks to match innovators and market disruptors with like-minded investors who are passionate about what those companies have to offer.

Want to find out more about Minerva?

Minerva Business Angels is one of the UK’s fastest-growing angel investment organisations. The network began in 1994 and is part of University of Warwick Science Park Ltd. Run in its current form since 2010, Minerva supports more than 90 companies having raised over £63m of investments.

Minerva Business Angels is the second most active angel network in the UK, the second most active investor in green economy scale-ups, and the most prolific investor in the Midlands.

To find out more about Minerva Business Angels and whether you are eligible to become an investor, contact us today.